2016 in Summary and in Context

2016 in Summary

In 2016, the UK market reached new highs and stocks in a majority of developed and emerging market countries delivered positive returns. UK investors with overseas assets benefited from the decline of the value of the pound, with Sterling falling 16% against the US dollar.

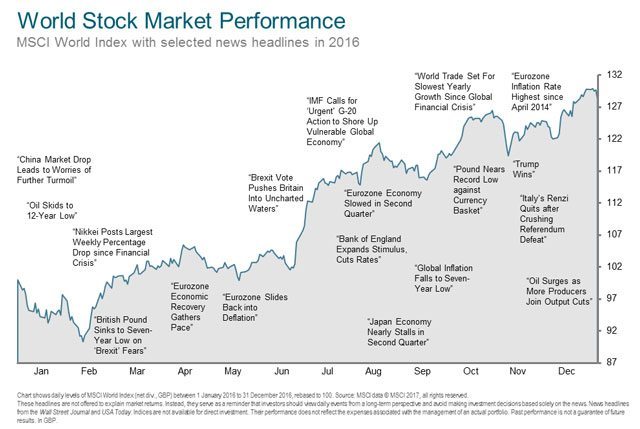

The year began with anxiety over China’s stock market and economy, falling oil prices, concern about the impact of the strong yen on the Japanese economy and uncertainty around the impact of the UK’s EU referendum. Many world equity markets were in steep decline for the first few weeks of the year. In spite of this shaky start, many markets ended the year close to (or breaking) all-time highs.

Many investors may not have expected global stocks and bonds to deliver positive returns in such a tumultuous year. This turnaround story highlights the importance of diversifying across asset groups and regional markets, as well as staying disciplined despite uncertainty. Although not all asset classes had positive returns, a globally diversified, cap-weighted portfolio logged attractive returns in 2016.

Consider that global markets are incredible information-processing machines that incorporate news and expectations into prices. Investors are well served by staying the course with an asset allocation that reflects their needs, risk preferences and objectives. This can help investors weather uncertainty in all of its forms.

2016 in Context

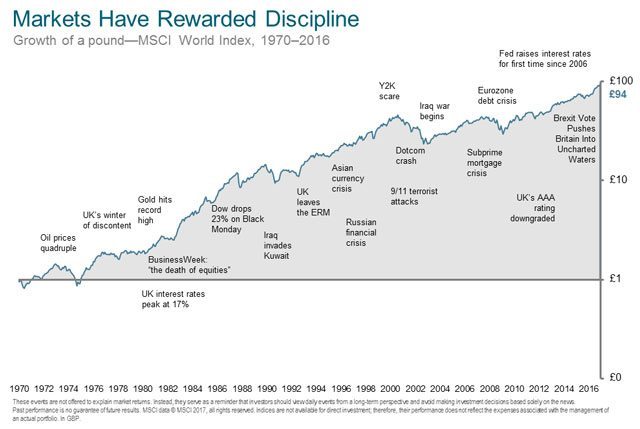

Global equity markets have enjoyed strong returns since the financial crisis of 2008–09, and many times in the past few years, people have speculated about what might halt the rise of global equity markets. Several events occurred in 2016 that were suggested as potential catalysts for markets to decline. However, a globally diversified, cap-weighted portfolio delivered positive returns in 2016.

The chart above puts 2016’s return in a long-term context. It illustrates that investors have enjoyed positive long-term returns throughout the 1970s crisis, Black Monday, Black Wednesday, wars, currency crises, bubbles and crashes. 2016 adds to that list with Brexit and the US presidential elections. This shows that, rather than making investment decisions based on headline news, investors are better served by following a disciplined approach to investing, based on a long-term financial plan that reflects their individual needs, risk preferences and objectives.

“If three or five years of returns are going to change your mind [on an investment], you shouldn’t have been there to begin with.”

—Eugene Fama – American Economist and Nobel Memorial Prize winner

This article is for information only and no action should be taken based on the information alone. If you are looking to invest or even review your finances then you should seek independent advice to ensure that any investment strategy fits your specific circumstances and objectives.