5 key tax changes to be aware of in the new tax year

Benjamin Franklin once said, “in this world, nothing is certain except death and taxes”. While you can’t generally avoid taxes altogether, understanding what you may have to pay and finding strategies to mitigate them can help you boost your wealth and reach your long-term goals.

It’s especially important to understand tax changes and how they may affect you, so you can continue being as tax-efficient as possible. The start of a new fiscal year on 6 April 2023 brought several notable tax changes that may affect your finances now and in the future.

Read on to learn about changes to Income Tax, Capital Gains Tax (CGT), the Dividend Allowance and pension allowances in the 2023/2024 tax year.

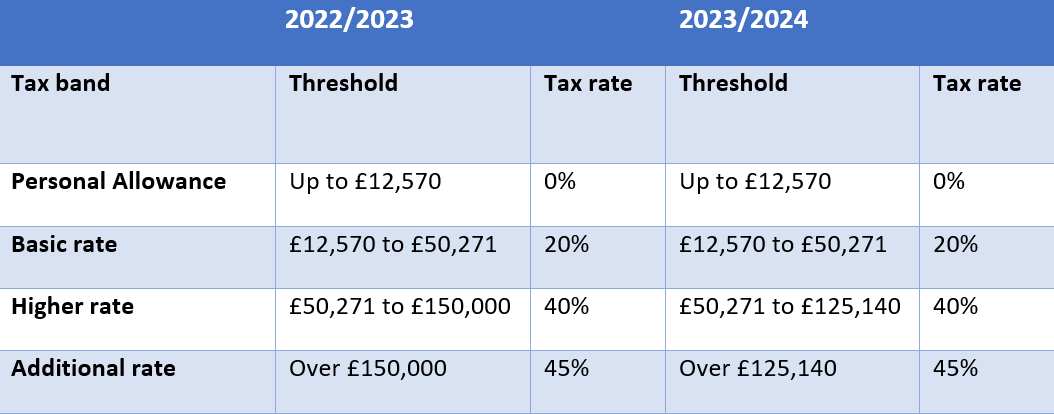

1. Basic- and higher-rate Income Tax band thresholds remain frozen, but additional-rate threshold dropped

The thresholds at which basic- and higher-rate Income Tax become payable have been frozen until April 2028.

Though this may seem positive as it is not a direct tax increase, it could mean that you pay more Income Tax in the years ahead. If your earnings increase while the thresholds stay the same, more of your earnings could be taxed at a higher rate.

In some cases, you may be pushed into a higher tax band as a result, meaning that you pay significantly more tax.

If you are a high earner, your tax liability could well increase because there has been a change to the threshold for the additional-rate tax band. It fell from £150,000 to £125,140 on 6 April 2023, with Which? suggesting that this could push an estimated 250,000 people into this tax band.

This change to the additional-rate threshold could significantly increase your tax bill – somebody earning £150,000, for example, will pay around an extra £1,200 in Income Tax a year.

Here is a summary of the changes to Income Tax bands in the 2023/2024 tax year.

It may be worth reviewing your income in light of these freezes and the reduction in the threshold at which additional-rate tax becomes payable. There may be ways to mitigate the amount of Income Tax you pay – perhaps through additional pension contributions – and expert advice could be useful here.

2. Capital Gains Tax annual exempt amount reduced to £6,000

CGT is charged on profits from the sale of assets like non-ISA investments, second homes, antiques, paintings, or jewellery.

Prior to 6 April 2023, the CGT annual exempt amount was £12,300, meaning that you would not usually pay tax on any profits up to that amount. However, the exempt amount was reduced to £6,000 on 6 April 2023.

The rate of tax you pay, which is based on your Income Tax band, did not change. There is also a separate rate for property sales.

Additionally, the CGT annual exempt amount will fall again, to £3,000, on 6 April 2024.

As a result of these changes, you may want to consider any asset sales and the CGT you will have to pay. Using tax-efficient wrappers such as ISAs can help you to reduce CGT as you won’t pay any CGT on profits you make from savings or investments held in an ISA.

It may also be beneficial to consider how your assets are divided between yourself and your spouse or partner. Everyone has an individual exemption to CGT so making use of both your exempt amounts could help to reduce your CGT bill.

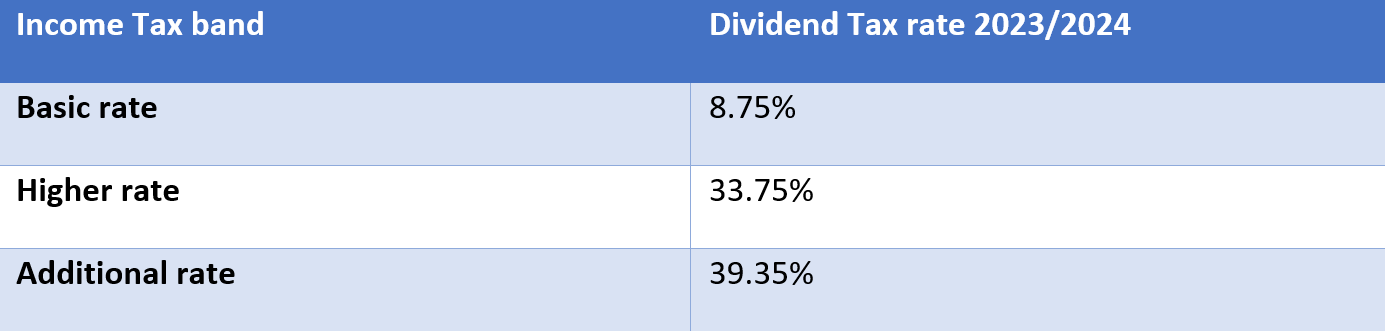

3. Dividend Allowance reduced to £1,000

The Dividend Allowance – the amount you can earn from dividends without paying Dividend Tax – was cut from £2,000 to £1,000 on 6 April 2023. A further cut to £500 is planned from 6 April 2024.

The rate of Dividend Tax you pay remained the same and, like CGT, is based on your Income Tax band.

The reduction in the Dividend Allowance could affect you if you earn income from dividend payments – perhaps because you have dividend-paying shares.

Additionally, if you’re a business owner you may notice the change more than others. While dividend payments have historically been a more tax-efficient way for you to pay yourself, the reduction to the Dividend Allowance may mean your tax bill will increase.

4. Annual Allowance increased from £40,000 to £60,000, and changes made to the Tapered Allowance and Money Purchase Annual Allowance

The Annual Allowance is the upper amount you can contribute or accrue in pensions on an annual basis and receive tax relief on.

The good news is that this allowance was increased from £40,000 to £60,000 from 6 April 2023. As a result of the change, you may be able to increase your retirement savings without facing additional tax charges.

If you are a high earner, you may still be affected by the Tapered Annual Allowance.

From 6 April 2023, if your “adjusted income” (essentially your earnings plus any employer pension contributions) is more than £260,000, the Tapered Allowance may come into effect. This will have the effect of reducing your Annual Allowance to, potentially, just £10,000.

The Money Purchase Annual Allowance (MPAA) has also been increased from £4,000 to £10,000. This is the annual amount you can pay back into your defined contribution (DC) personal pension tax-efficiently once you have started flexibly taking an income from it.

The increase in the MPAA could be positive if you keep working, or return to work, after you have started drawing your pension, and you want to continue to build your fund for later life.

The rules about allowances can be difficult to understand, so consider taking professional advice to determine how the changes could affect your retirement plans.

5. Lifetime Allowance set to be scrapped in April 2024

The planned abolition of the Lifetime Allowance (LTA) was perhaps the biggest surprise of the 2023 Budget.

The LTA dictates how much you can accrue into your pension tax-efficiently over your lifetime and, prior to 6 April 2023, it was set at £1,073,100.

Although it is not officially being abolished until a future Finance Bill, the LTA tax charge was removed from 6 April 2023. In practice, this means that you will no longer be affected by the LTA and may be able to contribute more to your pension tax-efficiently.

Get in touch

If you are unsure how these recent tax changes will affect you, we can give you the guidance you need.

Email info@britannicplace.co.uk or call 01905 419890.

Please note

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Past performance is not a reliable indicator of future results.

The tax implications of pension withdrawals will be based on your individual circumstances. Thresholds, percentage rates and tax legislation may change in subsequent Finance Acts.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.