Are pensions or property the best way to save for retirement?

Pensions and property are two of the most well-known stores of wealth that UK residents can use to save for retirement. But a question that’s often asked is: which of the two is better?

On the one hand, a pension allows you to directly set aside and invest a portion of your income throughout your working life. Meanwhile, investing in property gives you a tangible asset in a market that has, historically, steadily risen in value over time.

In fact, if you had bought a property at the start of 2021, you likely would have seen some returns on your investment already. According to the Office for National Statistics (ONS), the average UK house price had risen 10% over the year to November, when data was last available.

Conversely, you only have to look back a short time to 2008 to see the other side of this coin. These same ONS figures show that the average house price fell by 15.6% between February 2008 and February 2009.

The average property at this time would likely have not seen any growth in value until 2010, either.

Meanwhile, it seems that UK adults prefer pensions as a home for their money. Indeed, data from the ONS published by MoneyAge shows that adults in the UK actually have £1 trillion more wealth held in pensions than tied up in property.

Whether this figure goes to show pensions’ superiority or simply their accessibility is difficult to say. But it certainly does open the floor for the debate as to whether pensions or property is the best strategy for saving for retirement.

So, here are a few things to consider if you’re wondering whether pensions or a property investment is the best option for you.

Property produced returns of nearly 50% in the past decade compared to 100% for global stocks

The first area to consider is past performance and returns. Obviously, while this can’t tell us what will happen in the future, it can still be useful to see what would have happened if you’d prioritised one over the other in the recent past.

Interestingly, while a common perception of property is that it’s far more solid and lucrative, pensions made up of global stocks would have likely outperformed bricks and mortar in the last decade.

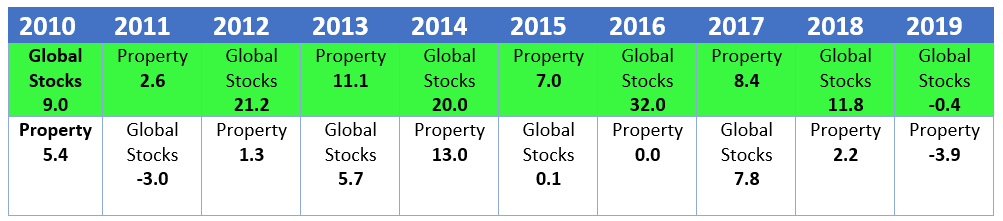

The table below shows the average annual returns of property against global stocks between 2010 and 2019, with the top-performing asset of the two for each year highlighted in green:

Source: Royal London

While global stocks don’t necessarily fully equate to the typical construction of a pension, these figures still make a good point of comparison and paint a fascinating picture. Some key takeaways include:

- Property finished above global stocks four times throughout the 10-year period. However, on two of those occasions the difference was marginal.

- Global stocks produced average annualised returns of 104.2% over the period, compared to just 47.1% for property.

- Property’s annual returns finished at 0% and below in both 2016 and 2019, respectively.

As you can see, while the figures are close, a pension constructed of global stocks would likely have outperformed a property investment throughout the decade.

Of course, past performance is no indicator of future performance. There’s no guarantee that any of these asset classes will provide the same results moving forwards.

Property can come with high costs and be difficult to access

A downside to property is that it can be expensive when you want to start investing in it, and illiquid if you want to use the value within it in your retirement.

Rising house prices are great if you already own a property. But that means to buy one in the first instance, you’ll need to have that money to hand, or take out a buy-to-let (BTL) mortgage and make repayments over a long period.

On top of the actual costs to buy, there is a range of other costs that you may have to meet, including:

- Stamp Duty Land Tax (SDLT), depending on the value of the property

- Estate agent, solicitor, and conveyancing fees

- Costs to refurbish the property

- Any insurance or protection cover you take out on the property

- Income Tax on any rental income

- Regular servicing and inspection fees, such as gas and electrical safety

- Capital Gains Tax (CGT) on any value growth when you come to sell the investment – this could be up to 28% on any profit you’ve made if you’re a higher- or additional-rate taxpayer

- Inheritance Tax (IHT) on your death, as the property may be included in the value of your estate.

You may think that you can offset some of these costs with rent payments you’ll receive from tenants. However, this presumes you’ll be able to consistently find tenants to make these payments.

Additionally, in order for a property to provide you with an income in retirement, you either have to:

- Rent it out – and you’ll only then receive the profits after you’ve paid any mortgage, lettings agent fees, tax, and so on.

- Sell it and use the proceeds to generate an income.

Assuming you manage to find a buyer, you may still receive less than the market value of your property, too.

In combination, all these factors can add up to make property an expensive and illiquid, inaccessible investment.

Fees and tax rules make pensions cost-effective

In total contrast to property, pensions tend to be far more cost-effective. Of course, while you may have to borrow money to take out a mortgage, you don’t have to do this to invest in a pension. As a result, it is difficult to accurately compare the costs of the two.

Still, there are significant benefits of a pension that can make them a more efficient home for your money.

For one thing, any management costs you’ll pay are typically taken as a percentage of the returns your pot generates, rather than having to pay them upfront.

Pensions are also tax-efficient, as your contributions benefit from tax relief at your marginal rate of Income Tax.

This sees basic-rate taxpayers receive 20% tax relief, meaning a £100 pension contribution only “costs” £80. For higher- and additional-rate taxpayers, £100 costs just £60 and £55 respectively.

Additionally, any investment growth your pension generates will be free from Income Tax and Capital Gains Tax (CGT).

In general, your pension will fall outside of your estate, too. That means the value contained within it may not be subject to Inheritance Tax (IHT) when you pass away, allowing you to leave the wealth within it to your beneficiaries. By contrast, property will form part of your estate for IHT purposes.

While you typically can’t access it until later life, your pension is a relatively liquid asset compared to property, too.

Under current rules as of the 2021/22 tax year, you can usually start taking money from your pension from age 55. This age is set to rise to 57 in 2028.

All in all, this means using a pension can be cheaper in the short term, could save you a tax bill in the future, and is more accessible than property when you want to access it in retirement.

Property can still feature in your retirement strategy

Of course, even with these various downsides of property, there can still be room for it as part of a balanced retirement strategy.

Investing in a tangible asset such as property can be sensible if you’re careful, and the average annualised returns of nearly 50% from 2010 to 2019 still represents a healthy return. Provided you make wise decisions, property could certainly offer something to your retirement.

Indeed, holding onto a property that you’ve inherited or that you’ve already purchased and paid for years ago could make perfect sense as part of your overall strategy. You wouldn’t have to worry about challenges such as mortgage payments or fees associated with buying property, making this cost-effective, too.

Even so, with the tax-efficient benefits and accessibility, it’s somewhat unsurprising that pensions remain a favoured and much-used tool to build wealth for later life.

Get in touch

If you’d like to find out more about pensions and property, or you’d just like to discuss your retirement strategy further, please do contact us at Britannic Place.

Email info@britannicplace.co.uk or call 01905 419890 for more information.

Please note

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Levels, bases of and reliefs from taxation may be subject to change and their value depends on the individual circumstances of the investor.

Workplace pensions are regulated by The Pension Regulator.

Your home may be repossessed if you do not keep up repayments on a mortgage or other loans secured on it.

Buy-to-let (pure) and commercial mortgages are not regulated by the FCA.

Think carefully before securing other debts against your home.

This article is for information only. Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

Get in touch, we’d love to help you

Do you need a financial planner?

Not everyone needs us, but find out if you need a financial planner. Answer 10 questions in 120 seconds and we’ll tell you.