Are you one of the 1.2 million people about to be pushed into a higher tax band?

As we move into the 2022/23 tax year, we’re finally going to start seeing the effects of Rishi Sunak’s 2021 spring Budget, in which the chancellor announced freezes to some key tax allowances and thresholds.

Sunak confirmed that the following allowances and thresholds will be frozen up until and including the 2025/26 tax year:

- Personal Allowance, the amount you can earn before you owe any Income Tax, is frozen at £12,570.

- Capital Gains Tax (CGT) exempt amount, the maximum amount you can make in gains before CGT is due, is frozen at £12,300.

- Pension Lifetime Allowance (LTA), the maximum amount you can contribute across all your pensions without incurring a tax charge when you come to withdraw it, is frozen at £1,073,100.

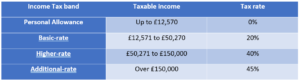

One particularly important freeze was to the Income Tax bands. While these were marginally increased from 2020/21 to 2021/22, the chancellor confirmed that they would then be frozen until April 2026.

That means the Income Tax bands up to and including the 2025/26 tax year will be:

Source: gov.uk

While this may not sound like a serious issue, it could see you squeezed into the next tax band over the coming four years, as your earnings will likely increase while the bands stay the same.

Find out more about what this means below, as well as a few ideas for what you could do about it.

1.2 million people to be pushed into a higher tax band

Figures first reported by the Telegraph and published by MoneyAge show that this freeze will push 1.2 million workers into the higher-rate tax band.

That will see them owe 40% Income Tax on the portion of their earnings that now exceeds this higher threshold.

Additionally, a further 1.5 million people on low pay will exceed the Personal Allowance and start paying Income Tax on their earnings, too.

Figures published in the Evening Standard suggest that this move could cost UK households a total of £10.9 billion in additional tax by 2025/26.

3 ways to reduce the effects of this tax freeze on your earnings

If you’re concerned that you may be pushed into a higher tax band by these freezes, you may be wondering what you can do about it.

Here are three things you could consider that may help.

- Increase your pension contributions

The first thing you could consider doing is paying more of your earnings into your pension.

When you make pension contributions, you typically receive tax relief, with the amount determined by your marginal rate of Income Tax.

In essence, this means that a £100 pension contribution “costs”:

- £80 for basic-rate taxpayers

- £60 for higher-rate taxpayers

- £55 for additional-rate taxpayers.

Of course, if you’re one of the 1.2 million about to be pushed into the higher-rate tax band, that means you may be able to benefit from a higher rate of tax relief. That’s because you’ll be able to claim higher-rate tax relief for the portion of your earnings that now exceed the £50,271 threshold.

Bear in mind that you will need to claim higher- or additional-rate tax relief through a self-assessment tax return.

You can also only receive higher- or additional-rate tax relief on contributions equal to the portion of your income that exceeds the tax band.

So, for example, if you earned £52,000, only the £1,729 that exceeds the higher-rate threshold would be eligible for tax relief at 40%.

- Consider salary sacrifice

Rather than making additional pension contributions, you could ask your employer whether they would consider a salary sacrifice arrangement instead.

Salary sacrifice involves reducing your take-home pay from your employer in return for a non-cash benefit. This could be anything from a company car to employer-provided childcare.

Crucially, it can also involve receiving additional employer pension contributions instead of a part of your salary.

In doing so, you may be able to reduce the amount of taxable income you receive, while still technically earning an equivalent amount. This could ensure that you stay in a lower tax band, while still being equally compensated for your work.

Of course, you may still separately owe tax if the benefits you receive are considered to be a “benefit in kind”.

Bear in mind that salary sacrifice may reduce the value of any work benefits you receive, such as a death in service arrangement. It could also have an effect on things that are calculated from your salary, such as mortgage affordability or means-tested benefits.

Make sure you factor considerations like this in first before you take salary sacrifice.

- Consider tax-efficient investments

Another option could be to consider tax-efficient investments. Two options that may suit your needs could be the Enterprise Investment Scheme (EIS) or investing in a Venture Capital Trust (VCT).

The EIS and VCTs are higher-risk investments that involve putting your money into smaller companies in need of funding.

Crucially, the government offers generous tax advantages to encourage investment in them. Notably, this includes 30% Income Tax relief on:

- Up to £200,000 of VCT investment

- Up to £1 million of EIS investment, and up to a further £1 million for investment in “knowledge-intensive” companies.

Bear in mind that there are other tax rules associated with the EIS and VCT investments, and these are higher-risk investments that may not be suitable for all investors.

Speak to us

At Britannic Place, we help you to plan for your financial future, no matter which tax band you find yourself in.

Email info@britannicplace.co.uk or call 01905 419890 for more information.

Please note

This article is for information only. Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Levels, bases of and reliefs from taxation may be subject to change and their value depends on the individual circumstances of the investor.

Workplace pensions are regulated by The Pension Regulator.

Enterprise Initiative Schemes (EIS) and Venture Capital Trusts (VCT) are higher-risk investments. They are typically suitable for UK-resident taxpayers who are able to tolerate increased levels of risk and are looking to invest for five years or more. Historical or current yields should not be considered a reliable indicator of future returns as they cannot be guaranteed.