Concerned that you may have lost pension pots? Here’s what you could do about it

On 30 October, it’s National Pension Tracing Day, an awareness day that encourages UK savers to check that they know about any pensions they might have lost over the years.

Whether it’s because you’ve worked at many different places each with a new scheme, or you moved home without telling your provider, it’s possible you’ve lost one of your pension pots over the years.

If you think you may have done, you might feel reassured to know that you’re far from alone.

Indeed, according to 2020 figures from the Association of British Insurers (ABI), there was an estimated £19.4 billion lying unclaimed in 1.6 million pensions – equivalent to nearly £13,000 each – simply from savers moving home without updating their provider.

Furthermore, a recent poll by iSipp published by FTAdviser revealed that a third of savers are worried that they have funds from workplace schemes that they subsequently lost or forgot about after changing jobs.

So, if you’re concerned that you have missing funds, find out how to track down your lost pension pots.

Before you begin: are you likely to have lost pension funds?

Ahead of trying to chase down lost pension funds, it may first be worth working out whether you’re likely to have any. This is particularly true for defined benefit (DB) pension arrangements, as the way these schemes are organised has changed over the years.

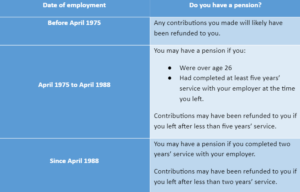

The table below shows you whether you may have lost funds in a DB scheme, depending on when you were employed:

It may be worth checking this carefully before you start searching for any lost funds.

3 simple methods that can help you to find lost pensions

If you think you may have lost pension funds that you’d like to hunt down, then these three simple methods could help you find them.

1. Speak to your previous providers

Your first option is to contact your pension providers and ask whether you have funds held with them.

Whether it’s a workplace or private scheme, your provider is supposed to send you an annual statement. So, check any old documentation you have to see whether there are details of schemes that you might have been enrolled in.

Remember to collate as much information as possible before you contact them. This could include everything from basic information, such as your date of birth and National Insurance number, to specific details such as your unique reference number for the plan or the date you were enrolled.

With this information to hand, your provider should be able to identify you and then allow you to ask questions about any funds you hold with them.

2. Ask your former employers for details

Your next option if you can’t remember the pension providers and have no paperwork to work this out, is to speak to your former employers and ask them for details of the schemes they used. Then, you can simply contact the scheme provider directly.

It is possible that you won’t be able to speak to your former employer. For example, if the company no longer exists, there may be no one left to contact.

In that case, it may be worth asking one of your former colleagues. They will likely also be enrolled in the scheme, or at least have had the option to be. As a result, they may know who you need to contact to find out whether you have any remaining funds.

3. Use the government’s Pension Tracing Service

If you’ve been unable to find details from either the pension provider or your former employers, you could use the government’s Pension Tracing Service instead.

Launched in 2016 by the Department for Work and Pensions (DWP), the Pension Tracing Service is a simple, free tool that offers instant trace results on any pension savings you have. It allows you to search a database of more than 200,000 providers, both workplace and private schemes, so you can then contact the right one.

To use the service, you will need to provide as much information as possible. This could include:

- Your employer’s name, or the pension provider your funds are held with

- Other employer details, including what type of business it ran and any changes to its name or address

- Dates of when you would have belonged to the scheme.

You can access the Pension Tracing Service for free on the government website.

Work with us

If you’d like to find out more about how financial planning could help you, please get in touch with us at Britannic Place.

Email info@britannicplace.co.uk or call 01905 419890 to speak to us today.

Please note

A pension is a long-term investment. The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Your pension income could also be affected by the interest rates at the time you take your benefits.