Everything you need to know about the increase to the State Pension

In October, the government confirmed that the amount of State Pension retirees receive will increase by 3.1% in the 2022/23 tax year, starting on 6 April.

While this may not sound that significant to you, the State Pension is a great foundation for the rest of your retirement income, especially as it’s a guaranteed income that you’ll always be able to rely on.

So, find out everything you need to know about the increase to the State Pension.

The basic or new State Pension

You can start claiming your State Pension if you’re at or over the State Pension age of 66, rising to 67 by 2028. The amount you’ll then receive will depend on whether you receive the basic State Pension or the new State Pension.

You’ll receive the basic State Pension if:

- You’re a man born before 6 April 1951

- You’re a woman born before 6 April 1953

To receive the full amount of the basic State Pension, you’ll need to have made at least 30 qualifying years of National Insurance contributions (NICs).

Meanwhile, you’ll receive the new State Pension if:

- You’re a man born on or after 6 April 1951

- You’re a woman born on or after 6 April 1953

The rules for how much new State Pension you’ll receive are slightly different to that of the basic State Pension. In this case, you’ll need to have made a minimum of 10 years of qualifying NICs to receive any State Pension.

To receive the full amount, you’ll need to have made at least 35 years of qualifying contributions.

Up to £288 more a year for your retirement

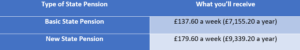

Currently, in the 2021/22 tax year, the amount of State Pension you will receive is:

Sources: the basic State Pension and the new State Pension

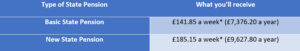

Then, from 6 April 2022, this amount will increase by 3.1% to:

Source: gov.uk * rounded to the nearest 5 pence

Rounding these figures up to the nearest five pence, that means you could receive up to an extra £288.60 a year if you receive the new State Pension and made enough years of qualifying NICs during your working life.

The suspension of the triple lock

With this 3.1% increase to the State Pension now confirmed, you may have also heard about the suspension of what’s known as the “triple lock”.

Ordinarily, the government is committed to increasing the State Pension in line with wider economic activity each tax year.

This increase is normally calculated from one of three metrics, with the government using the highest one to make the decision:

- A flat increase of 2.5%

- Average year-on-year earnings growth from the period between May to July

- Inflation in the year to September, as measured by the Consumer Price Index (CPI).

However, due to uneven activity in the job market caused by the Covid-19 pandemic, average earnings growth in the relevant period from May to July had risen as high as 8%.

Of course, this figure is not necessarily representative of wider economic activity. Rather, it reflects distorted growth over the year from 2020, when businesses were unable to operate due to lockdowns and other Covid-19 restrictions, to the easing of these rules in 2021.

As a result, the government decided to suspend the triple lock this year.

A guaranteed income that rises with economic activity

Even so, they did still commit to protecting the State Pension with a double lock by choosing to increase it by the rate of inflation, rather than the flat rate of 2.5%.

It’s for this exact reason that the State Pension is so valuable to you: it provides a guaranteed income in retirement that will rise over time in line with wider economic activity.

That means, if you made enough qualifying NICs in your working life, this money could provide a solid foundation for your retirement strategy.

So, while it might not provide enough to reach your retirement goals by itself, this 3.1% increase could still be valuable to you.

Speak to us

If you’d like to find out more about what the increase to the State Pension will mean for you or you have any other concerns about your finances and retirement, please do speak to us at Britannic Place.

Email info@britannicplace.co.uk or call 01905 419890 to speak to one of our experienced advisers.

Please note

This article is for information only. Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

A pension is a long-term investment. The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Your pension income could also be affected by the interest rates at the time you take your benefits.