How we can help you to plan for the costs of long-term care

The costs of long-term care are a concern for many people as they get older, particularly in the current climate where there have been notable reforms to the social care system.

In fact, from a survey we carried out recently, we found that some of our already retired clients said they were worried that they might not be able to afford these costs down the line.

This is an understandable concern; after all, long-term care in later life can be expensive, particularly if you have to rely on it for many years.

That’s why it can be reassuring to know the facts about long-term care, including the average costs that adults in the UK typically pay, how many people actually rely on it, and how much government support you could receive.

Most importantly of all, it’s good to know that there are things you can do and help you can seek if you still have concerns.

So, find out everything you need to know about the costs of long-term care, including how we can help you to plan for your future.

The costs of care

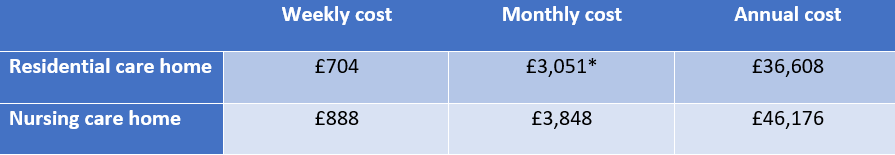

Let’s start with how much you might typically have to pay. The table below shows the average costs of care in the UK as calculated by carehome.co.uk, a care home search and review site.

These figures distinguish between residential care homes, for those without specialist care needs, and nursing care homes, which do cater for specialist care needs such as dementia:

Source: carehome.co.uk *figure rounded to the nearest pound

Source: carehome.co.uk *figure rounded to the nearest pound

According to the British Geriatrics Society, the average life expectancy of a resident in a care home is 24 months, and 12 months for nursing care homes.

That means, if you needed care, then on average you could expect to pay between £46,000 and £73,300.

It’s important to note that, in September 2021, the government set the new care-fee cap for how much you’ll have to pay for your care at £86,000.

However, this amount only covers your personal care costs, not the cost of your accommodation, utility bills, food, or any other expenses while you’re in care.

This could mean that you end up paying more than the £86,000 cap.

Not that many people will require care

Understandably, the prospect of paying these costs for long-term care can seem daunting, especially because so many people seemingly rely on these services.

But this perception isn’t entirely accurate. In fact, most people remain living at home, even in old age.

According to charity care provider Methodist Homes (MHA), more than 15.5 million people in the UK are aged 60 or over – making up nearly a quarter of the entire population. Even so, only a small proportion of these individuals live in care homes in the UK.

Data on how many people live in care in the UK is often uneven as England, Scotland, Wales, and Northern Ireland collect and report through different mediums, but Statista recorded just over 490,000 care home residents in the UK in 2020.

That’s just over 3% of those aged over 60 living in long-term care, and still only around 15% of those aged 85 or older.

That means it’s statistically unlikely that you’ll find yourself in this position.

Means testing for state support

It’s worth remembering that, even if you do need to rely on care in later life, you may be eligible for help from the state. This depends on what’s called “means testing”, which essentially assesses your ability to pay for your own care.

Means testing mostly revolves around your capital assets. This is the total value of all your savings and investments, including your family home unless it’s still occupied by a partner, relative, or dependent over age 60.

If you have less than £14,250 in capital assets, the state will pay for the costs of your care entirely. Meanwhile, for those with capital assets of more than £23,250, you’ll be entirely responsible for those costs.

Those in-between these two thresholds will have their care costs partially subsidised, depending on how close to the £23,250 limit they are.

From October 2023, these thresholds will be raised as part of wider social care reforms, with a new lower limit of £20,000 and an upper limit of £100,000.

This could make a significant difference in how you pay for your care.

Setting money aside for your care

If you have capital assets over the means test limit and you’re still concerned about how to pay for care, then it may be sensible to consider finding ways to set some money aside for this.

For example, if you’re not yet retired, you could set up a savings fund and leave some of your income in a pot each month to build dedicated funds for your care.

Or you could consider earmarking funds in your pension with the express intention of using them to pay for care if you ever need to.

Whatever you decide to do, it’s important not to set aside money for care if you’ve saved it up throughout your lifetime specifically for your retirement. Using money in this way could severely hamper your ability to live the lifestyle you want in your post-work life, especially considering you’re relatively unlikely to need long-term care anyway.

That’s why it’s often best to take financial advice from a professional financial planner. A planner can help you work out how much you may be entitled to in state benefits.

They can also use cashflow modelling to see how much you can afford to put towards your care while living your ideal lifestyle in your later years.

Work with us

If you have concerns over how much later-life care might cost you and you’d like to discuss the most suitable strategies to help you pay for your care, then please get in touch with us at Britannic Place.

We can help you with a financial plan that ensures you’ll be able to pay for your care, helping to put your mind at ease for the future.

Email info@britannicplace.co.uk or call 01905 419890 to speak to one of our experienced advisers.

Please note

This article is intended for information only and does not constitute financial advice.