The tax burden on retirees’ income is significant. Here’s what you could do about it

It’s often thought that the tax burden is the responsibility of the working generations, seeing them contribute to the public purse from their employed earnings.

This is of course largely true – Income Tax and National Insurance contributions (NICs) paid by employed workers and business owners are considerable elements in the government’s tax take.

However, a fact that’s often overlooked is that retirees’ income makes up a notable portion of it, too. According to research published in Professional Adviser, retired households now face a 15.4% direct tax on their income each year, adding up to more than £57.22 billion.

The average bill for direct taxes on a retired household lies at £4,961, predominantly constructed from Income Tax, Council Tax, and NICs.

This is of serious concern for retirees for two reasons:

- You’ll need this money to fund your goals and ambitions in retirement. The more you pay in tax, the less you’ll have for achieving these goals.

- Outside of any State Pension you receive, your funds are finite. Beyond interest and investment growth, you likely won’t be earning any more money.

As a result, you can imagine why it’s so important to find methods that can mitigate your tax bill in retirement.

When you work with us at Britannic Place, we always build these considerations into the financial plan we create for you.

So, find out the methods at your disposal to limit your retirement tax burden, allowing you to focus on using your wealth to fund your dream lifestyle.

1. Draw your retirement income tax-efficiently

The first thing you can do is try to draw your retirement income as tax-efficiently as possible, especially from your pension, to minimise your Income Tax bill.

According to the research in Professional Adviser, the largest portion of Income Tax came from that on private pensions, with the average bill lying at £3,359 – nearly 70% of the average bill.

As a result, carefully drawing income so that you lie in a lower tax band can make a significant difference to your tax burden.

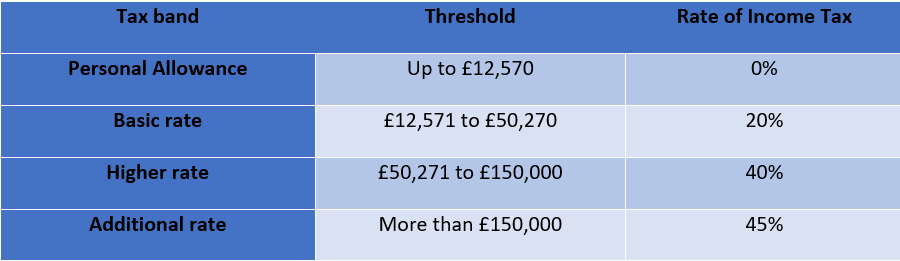

The table below shows you the Income Tax rates in the 2022/23 tax year:

In April 2023, the additional-rate threshold will also be reduced to £125,140, meaning even more retirees may be in line to pay the top 45% rate.

So, by carefully drawing income from your pension, you may be able to keep yourself in a lower tax band, reducing the rate of Income Tax you pay.

Meanwhile, if you can form part of your income by withdrawing investments held in a General Investment Account (GIA), you would be able to make use of the Capital Gains Tax (CGT) exempt amount and the Dividend Allowance, too.

Standing at £12,300 in the 2022/23 tax year, the CGT exempt amount allows you to liquidate investments that have generated gains before tax is due.

Tax is typically only charged on gains an investment has made. So for example, had you bought shares for £20,000 that were now worth £40,000, only the £20,000 would be liable for tax.

The CGT exempt amount would then reduce this taxable sum to £7,700, further limiting the tax bill you’d face.

Meanwhile, the Dividend Allowance means that you don’t pay tax on any dividend income that falls within a set level. This stands at £2,000 in 2022/23. That means any dividends you receive from your investments will also be free from tax up to this threshold.

It’s worth noting that both the CGT exempt amount and Dividend Allowance are set to be reduced in April 2023, falling to £6,000 and £1,000 respectively. These allowances will also be further reduced in April 2024 to £3,000 and £500 respectively.

Even so, if you can design an investment portfolio with this in mind, this means you may be able to draw an additional sum of tax-free income from your invested funds.

2. Draw money from your ISAs

Another method that can help you save in tax is drawing income you’ve saved and invested through ISAs.

ISAs are considered “tax-efficient” as any interest generated on money saved in a Cash ISA is free from Income Tax, while investments in a Stocks and Shares ISA are entirely free from CGT and Dividend Tax.

You may well have used ISAs as a savings and investment vehicle throughout your career. So, now that you’ve reached retirement, you could start drawing on these funds to make the most of the Income Tax and CGT-free funds.

As ISAs will typically contribute to the value of your estate, you may also be able to reduce a potential Inheritance Tax (IHT) bill in future. Your pension will typically not be included in your taxable estate, so using any ISA funds first could mean more of your wealth is passed to your beneficiaries without an IHT bill.

3. Make tax-efficient investments

If you’re willing to take on a bit of additional risk, another option you have is to make use of tax-efficient investments that offer Income Tax relief.

For example, investments in Venture Capital Trusts (VCTs) and the Enterprise Investment Scheme (EIS) both come with generous Income Tax relief incentives. These are up to:

- 30% Income Tax relief on up to £200,000 of VCT investment. You must hold your investment for at least five years, and it must retain its status for you to be able to claim tax relief.

- 30% Income Tax relief on up to £1 million of EIS investment – you can claim relief on a further £1 million if the investments are in “knowledge intensive companies”. You must hold your investment for at least three years, and it must retain EIS status.

Essentially, that means you can claim up to £60,000 Income Tax relief on VCTs, and up to £600,000 for companies involved in the EIS.

However, it’s crucial to be aware that VCT and EIS investments are both typically in smaller, less-established companies. As a result, the value of your investment is more likely to fluctuate up and down, and the businesses may even fail entirely. This could see you lose your entire invested sum.

You must fully understand the risks of VCTs and EIS investments before you invest, as well as the associated rules that come with them. If you aren’t sure whether these are appropriate investments for you, speak to an expert.

Get in touch

If you’d like to find out the most appropriate ways for you to manage your income in retirement, please get in touch with us at Britannic Place.

Email info@britannicplace.co.uk or call 01905 419890 to speak to an experienced adviser today.

Please note

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

All contents are based on our understanding of HMRC legislation, which is subject to change.

Enterprise Initiative Schemes (EIS) and Venture Capital Trusts (VCT) are higher-risk investments. They are typically suitable for UK-resident taxpayers who are able to tolerate increased levels of risk and are looking to invest for five years or more. Historical or current yields should not be considered a reliable indicator of future returns as they cannot be guaranteed.

Share values and income generated by the investments could go down as well as up, and you may get back less than you originally invested. These investments are highly illiquid, which means investors could find it difficult to, or be unable to, realise their shares at a value that’s close to the value of the underlying assets.

Tax levels and reliefs could change and the availability of tax reliefs will depend on individual circumstances.

Get in touch, we’d love to help you

Do you need a financial planner?

Not everyone needs us, but find out if you need a financial planner. Answer 10 questions in 120 seconds and we’ll tell you.