Why helping to care for your grandchildren can benefit you and your child financially

Raising children is one of the biggest expenses adults can face in their entire lives. Figures from Child Poverty Action Group show that in 2022, the cost of raising a child from birth to age 18 was £157,562 for couples, and £208,735 for lone-parent families.

A significant part of this is the cost of childcare, and the toll this takes on parents’ finances. According to charity Theirworld, childcare costs have led to one in five parents quitting full-time work or education.

Meanwhile, three-quarters of parents say they’ve had to make major changes to their finances to afford childcare, such as working more hours or even paying less for food shopping.

As a grandparent, you may well know what it’s like to face these pressures when you have a child. You might also have had to work longer hours to be able to afford childcare, or made concessions in your career to stay home with your child.

As a result, you might be thinking about helping your child and caring for your grandchildren for a couple of days a week, if you’re in the position to do so.

For example, if you’re working part-time ahead of retirement, or you’ve already stopped working, giving your time to take care of your grandchildren could help to alleviate some of the financial stress involved with raising children.

Interestingly, it can also be financially beneficial for you to care for your grandchildren as well. So, read on to find out why it could help both you and your child.

UK childcare costs are some of the highest in the developed world

A significant part of the issue parents face is that average childcare costs in the UK are among some of the highest in the developed world.

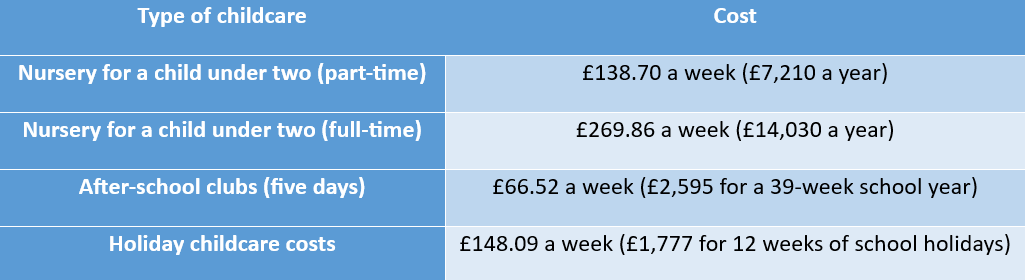

The table below shows the average cost for some of the most common types of childcare:

Source: MoneyHelper

These costs can quickly add up, especially if parents are paying for care for multiple children. So, by looking after your grandchildren for even part of the week and allowing your child to return to work, you could subsidise and maybe even entirely remove this cost for them.

This might allow your child to return to work part-time, allow them to take on a full working week, or continue progressing in their career so they can reach their maximum earning potential.

Of course, the financial benefits of being in part- or full-time work extend beyond just the salary that your child would bring home, too.

Your child might benefit from:

- Employer pension contributions

- Work-sponsored healthcare

- A death in service arrangement.

These extra perks that come from being in work can make a significant difference to your child’s finances. By caring for your grandchildren, your child might be able to save for their future at the same time, while also having the peace of mind that there’s protection in place to provide for their family if the worst were to happen.

Grandparents can claim National Insurance credits when caring for children

Crucially, the financial benefits of caring for your grandchildren can also extend to you if you’re yet to reach the State Pension Age of 66 (rising to 67 in 2028).

Parents can usually claim National Insurance (NI) credits when remaining off work to raise their children. But if another family member cares for the child while that parent returns to work, these NI credits can be transferred to that family member instead.

Typically, you’ll need 35 years of qualifying NI contributions and/or credits to receive the full new State Pension. However, you may have gaps in your record if you:

- Had earnings below the threshold where NI payments begin

- Were self-employed and didn’t pay contributions in years when you made small profits

- Lived or worked outside of the UK.

So, by caring for your grandchild, you may be able to top up these gaps by transferring credits from your child’s record to you. This could make you eligible for the full amount of State Pension, which stands at £203.85 a week in 2023/24.

You’ll be eligible to do this so long as you are caring for a child under the age of 12. You can also make a backdated claim as far back as 2011 if you were previously caring for a child but didn’t claim at the time.

There are a couple of other points to bear in mind here if you want to receive these credits:

- These are not given automatically, so you will need to apply for them alongside your child.

- Your child must be registered for Child Benefit – this is what allows them to receive an NI credit if they are not working, or not earning enough through work to receive an NI credit.

- Your child will need to earn enough through employment to gain an NI credit this way, after which you’ll then be able to claim the NI credit they were eligible for through Child Benefit.

It’s also important to note that if you already have enough qualifying years on your record, adding more credits for caring for your grandchild won’t boost how much you can receive from the State Pension.

It may be worth first checking your NI record to see whether you need additional credits – especially before you agree to looking after a toddler!

Get in touch

If you’d like to find out more about how to make the most of your money, please do get in touch with us at Britannic Place.

Email info@britannicplace.co.uk or call 01905 419890 to speak to us today.

Please note

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

All contents are based on our understanding of HMRC legislation, which is subject to change.